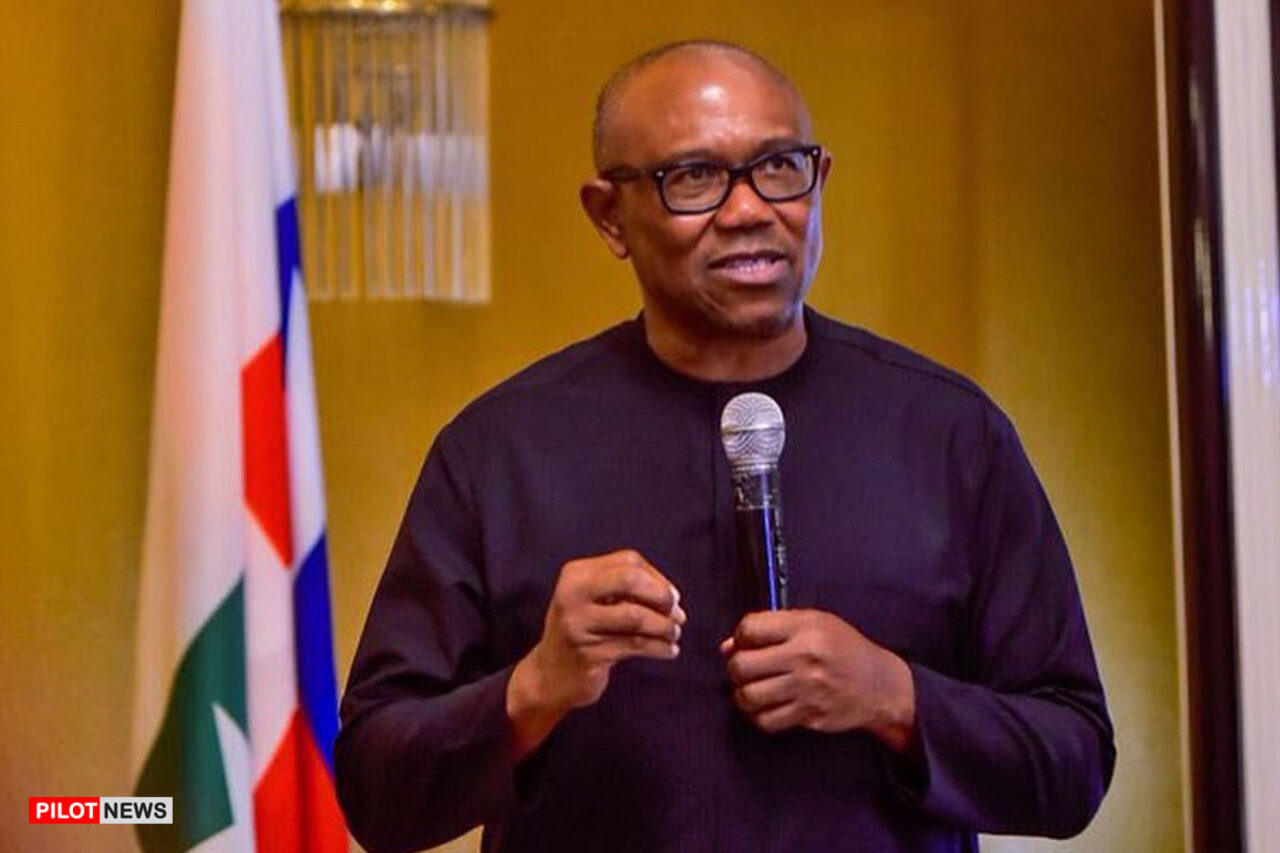

Former Anambra State Governor Peter Obi has criticised Nigeria’s current taxation approach, warning that prosperity cannot be achieved by placing heavier tax burdens on an already impoverished population.

In a statement issued on 2 January 2026, Obi argued that meaningful economic and social progress can only be built on honest leadership, transparency and national consensus, stressing that taxation must operate as a genuine social contract between government and citizens.

“As I travel the world and meet leaders who have transformed their nations, one lesson is clear: lasting economic and social progress begins with national consensus,” Obi said.

He added that transformative leadership is rooted in honesty, noting that “government must be transparent and truthful because citizens deserve nothing less from those who lead them.”

Obi said Nigeria’s tax policies should be measured against this standard of honest leadership, warning that taxation without clarity or fairness undermines public trust. “If taxation is to function as a genuine social contract, it must be rooted in sincerity, fairness, and concern for the welfare of the people,” he stated.

He argued that tax policies should be clearly explained to Nigerians, including their impact on incomes and how the revenue will contribute to national development. According to him, “without this transparency, taxation becomes a tool of confusion and burden rather than a mechanism for growth and development.”

The former governor maintained that the goal of fiscal policy should not merely be revenue generation but the creation of wealth among citizens.

“The purpose of sound fiscal policy is not merely to raise revenue; it is to make the people wealthier so that the nation itself becomes stronger,” he said, adding that Nigerians are currently being asked to pay more taxes “without clarity, explanation, or visible benefit.”

Obi identified the empowerment of small and medium-sized enterprises (SMEs) as the starting point for sustainable economic growth. “When small businesses thrive, jobs are created, incomes rise, and the tax base expands naturally,” he said, stressing that “you cannot tax your way out of poverty — you must produce your way out of it.”

He also expressed concern over what he described as an ongoing tax fraud saga, which he said was unprecedented in Nigeria’s history.

Obi claimed that “for the first time in Nigeria’s history, a tax law has reportedly been forged,” alleging that the National Assembly had admitted that the version of the law gazetted was not the one passed by lawmakers.

According to him, citizens are now being required to pay higher taxes under what he described as a “manipulated framework,” without transparency or corresponding benefits.

“There is no virtue in celebrating increased government revenue while the people grow poorer,” Obi said. “Taxing poverty does not create wealth; it deepens hardship.”

He concluded by calling for a fair, lawful, and people-centred tax system that supports production, rewards enterprise, and protects the vulnerable. Such a system, he said, is essential to restoring trust between the government and the people and making taxation a true instrument for unity, growth, and shared prosperity.

- Tinubu Welcomes Egbetokun’s Resignation, Appoints Tunji Disu as Acting IGP - February 25, 2026

- Tinubu Welcomes Egbetokun’s Resignation, Appoints Tunji Disu as Acting IGP - February 25, 2026

- Paris Saint-Germain’s Achraf Hakimi to Stand Trial over Rape Allegation - February 25, 2026